- ATO debt collection – as the economy emerges from COVID-19, the ATO is refocusing on debt collection, including taking firmer action where appropriate. If you or your business has a tax debt, it’s important to engage with the ATO with our assistance.

- Last minute trust distributions and record keeping – with fresh ATO guidance released on trust distributions, working with us on your distribution practices and the record keeping to support those practices is more important than ever.

- Super guarantee increases – as the new financial year begins, so too does an increase to the super guarantee (SG) rate from 10% to 10.5%. Although this sounds straightforward, there are complexities involved. The new financial year also sees changes to the SG entitlements for your lower-paid workers.

- The ATO’s Tax Time focus for small business – the ATO has released its Tax Time focus areas. Declaring income from side-hustles, the three golden rules for claiming tax deductions, and meeting lodgement deadlines are all on the ATO’s radar.

- Tax scam myths – it’s peak period for tax scams! However, they happen all year round. We debunk some of the myths around tax scams, including that older people are more susceptible to them, and that they are always easy to detect.

- STP year-end finalisations – these are generally due in mid-July and are an important employer obligation. As your registered agent, we can assist you in this year-end process.

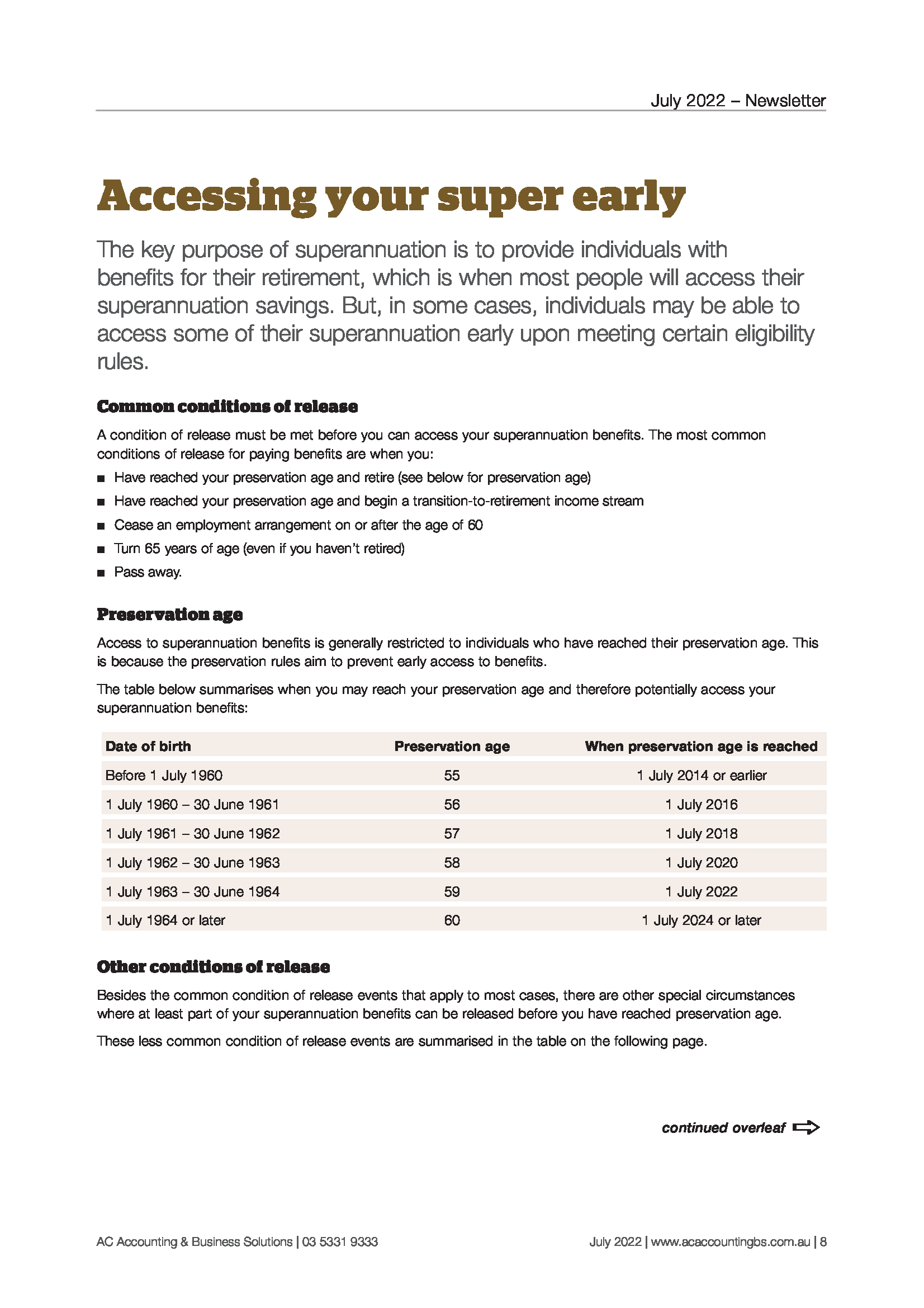

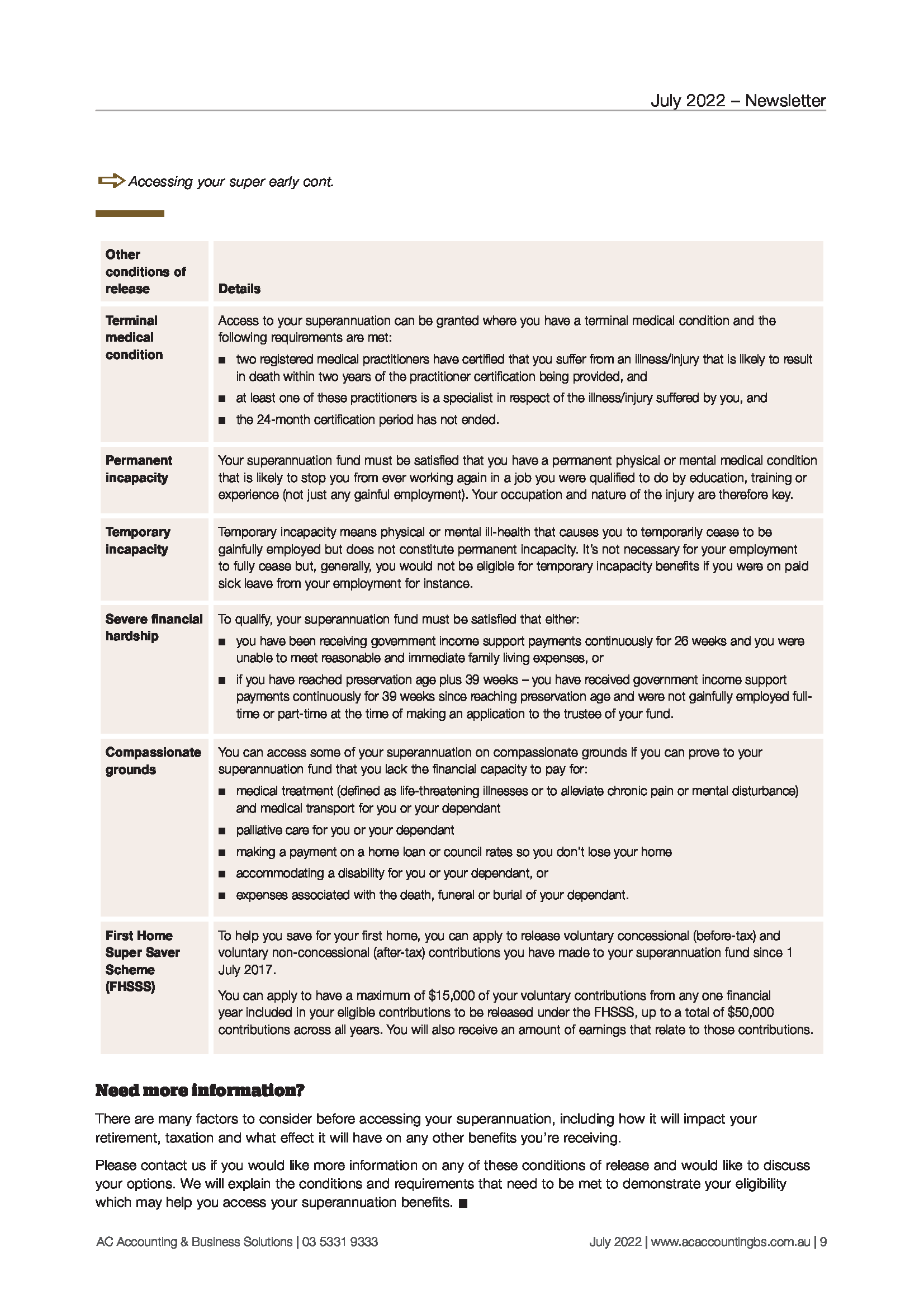

- Accessing your super early – although turning 60 and quitting your job, or turning 65, or passing away are some of the most common circumstances that allow you to access your superannuation, there some other lesser-known access points. These include, severe financial hardship, compassionate grounds, temporary incapacity…and more.

Happy reading…